Reliable and Reliable Payroll Services by CFO Account & Services

Reliable and Reliable Payroll Services by CFO Account & Services

Blog Article

Taking Full Advantage Of Performance and Accuracy With Comprehensive Pay-roll Services for Small Companies

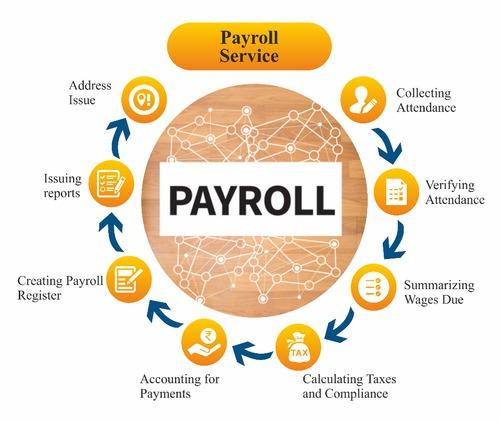

In the world of small company operations, the ins and outs of handling pay-roll can typically posture difficulties that need interest to information and performance. Amidst the complexities of pay-roll handling, the utilization of detailed pay-roll solutions can substantially enhance operations and boost accuracy. Small companies stand to take advantage of customized remedies that not just save time however additionally ensure adherence to regulative needs, using a seamless integration with bookkeeping systems. The mission for optimizing effectiveness and precision in payroll handling bids for a better assessment of the advantages that detailed pay-roll solutions can offer the table.

Benefits of Comprehensive Payroll Services

When considering the functional effectiveness and monetary management of a little company, the advantages of extensive pay-roll services end up being increasingly noticeable. Small service owners and their team can concentrate on core organization tasks rather of obtaining bogged down in taxing pay-roll tasks.

Additionally, thorough payroll services frequently provide sophisticated coverage abilities, giving small company owners valuable understandings into their labor prices and trends. This information can educate tactical decision-making and assistance maximize staffing degrees to enhance performance and success. Additionally, by entrusting pay-roll to specialists, small companies can improve safety and discretion, protecting delicate employee details from prospective violations. Generally, the advantages of detailed pay-roll services for tiny organizations are countless, varying from cost financial savings to enhanced precision and effectiveness.

Key Features for Small Services

The crucial components that make up the foundation of effective pay-roll administration for small companies are encapsulated in the crucial features tailored to satisfy their details needs. Tiny businesses commonly need payroll solutions that are economical, user-friendly, and compliant with regulations. One crucial attribute important for local business is automated pay-roll handling. This function saves time by simplifying pay-roll tasks such as computing reductions, taxes, and earnings, minimizing the possibility of mistakes.

Furthermore, local business gain from integrated pay-roll and HR functionalities. Having these systems interconnected makes sure smooth information flow in between payroll and HR departments, boosting accuracy and effectiveness. Another vital feature is tax obligation compliance support. Local business can stay clear of expensive penalties by making use of payroll services that remain updated with tax obligation laws and regulations, guaranteeing precise tax obligation filings.

In addition, adjustable reporting devices are crucial for little services to examine pay-roll information successfully. These devices give insights right into labor prices, staff member productivity, and spending plan preparation. Specialized client assistance is an essential function that little companies need to seek in a pay-roll solution company, making certain punctual aid and resolution of any payroll-related issues that might occur.

Ensuring Regulatory Conformity

In the realm of local business payroll management, adherence to regulative requirements stands as a fundamental column for operational honesty and lawful conformity. Small companies have to browse a complicated landscape of federal, state, and neighborhood guidelines governing payroll techniques to prevent costly penalties and charges. Guaranteeing governing compliance involves precisely remitting and keeping payroll taxes, adhering to minimal wage legislations, adhering to overtime policies, and appropriately categorizing workers as either permanent, part-time, or independent contractors. In addition, small companies need to remain notified concerning adjustments in tax obligation regulations and labor guidelines that can influence their payroll procedures. Failure to follow these guidelines can result in extreme consequences, tarnishing the track record of the company and resulting in economic consequences. For that reason, local business benefit substantially from partnering with comprehensive payroll services that have the knowledge and resources to navigate the detailed internet of governing demands, eventually protecting the service from prospective legal risks.

Automation and Time-Saving Devices

Offered the complex regulative landscape little companies have to navigate for pay-roll conformity, integrating automation and time-saving devices becomes important for making certain and enhancing processes precision. Automation can dramatically decrease hand-operated errors, save time, and improve effectiveness in pay-roll procedures (Payroll Services by CFO Account & Services).

In addition, automation enables little companies to create reports quickly, track employee hours properly, and stay updated with altering pay-roll laws. On the whole, leveraging automation and time-saving devices in payroll services empowers tiny organizations to run a lot more successfully, reduce errors, web and make sure conformity with lawful requirements.

Integration With Audit Equipments

How can little services enhance functional efficiency by integrating payroll services with accountancy systems? Incorporating pay-roll services with accountancy systems can enhance economic procedures, lower data access errors, and make sure consistency between payroll and economic documents. By syncing payroll and accounting systems, local business can automate the transfer of payroll information such as benefits, tax obligations, and salaries straight into their general my company ledger, eliminating the demand for hands-on settlement.

In addition, integration enables real-time updates, providing accurate financial understandings and making it possible for better decision-making. This combination likewise improves compliance by making sure that pay-roll tax obligations are properly determined, reported, and deposited in a timely manner. Small companies can conserve time and resources by eliminating duplicate data entrance jobs and minimizing the threat of expensive errors.

Final Thought

Finally, comprehensive pay-roll solutions use local business numerous benefits, including raised efficiency and accuracy. Key attributes such as automation and integration with bookkeeping systems assist in saving time and guarantee regulatory conformity. Payroll Services by CFO Account & Services. By using these services, small organizations can streamline their payroll procedures and concentrate on other vital aspects of their operations

Amidst the complexities of pay-roll handling, the usage of extensive pay-roll solutions can considerably streamline operations and boost accuracy. The mission for taking full advantage of effectiveness and precision in pay-roll handling bids for a better assessment of the advantages that thorough payroll services can bring to the table.

Tiny services benefit considerably from partnering with thorough pay-roll services that possess the knowledge and sources to browse the detailed internet of regulative demands, ultimately securing the company from potential lawful risks.

Incorporating pay-roll services with audit systems can you could check here improve monetary processes, minimize information access errors, and make certain uniformity in between pay-roll and economic documents. By syncing pay-roll and accounting systems, little services can automate the transfer of payroll data such as wages, benefits, and tax obligations straight into their general ledger, getting rid of the requirement for hands-on settlement.

Report this page